Have you experienced an electrifying moment when a renowned celebrity comes on the stage and the audience erupts in a symphony of cheers and applause? People wait and line up in queues to catch a glimpse of their favourite star. The star has reached a certain level of popularity with their brilliance and performance over the years.

The scenario of NPS investment is not a different tale. According to statista.com, the National Pension System had approximately 14 million subscribers in the financial year 2021 across India, and these are not small numbers. Still, most people are looking for NPS investment horizons to financially secure their retirement.

Why are people inclining towards NPS investment?

Scenarios have been changing, and many millennials are becoming more inclined towards retirement planning. They start looking for options to enjoy their lives after they stop working. But there are many financial influencers on the internet, and millennials can make hasty decisions without consulting any financial advisor or professional.

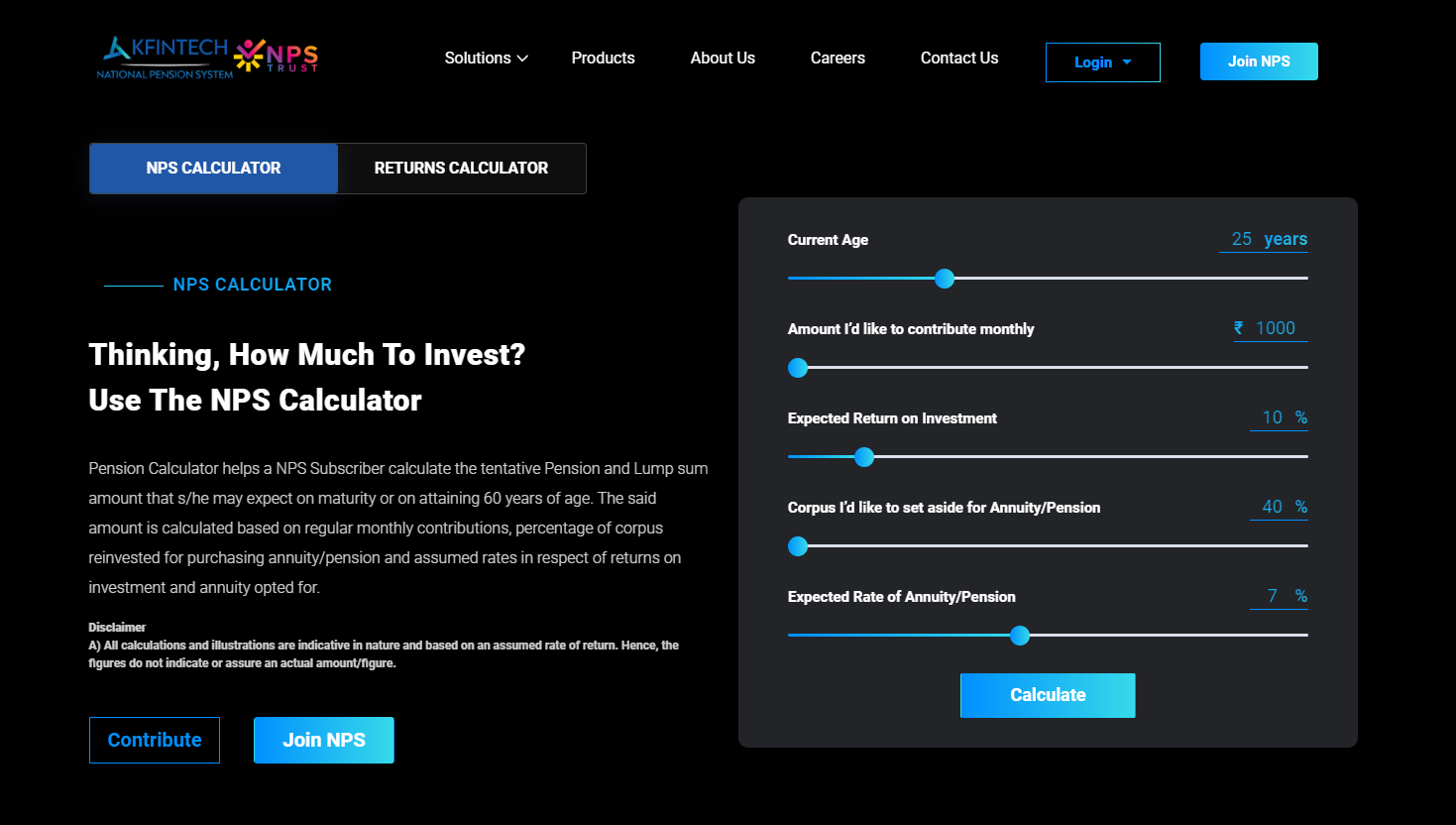

Retirement planning can be an uphill task if you are not sure about your goals or how to secure your future after retirement. Having stated that, a low-cost retirement solution like NPS investment offers a systematic and easy approach, which makes retirement planning easy.

What should you consider before choosing an NPS investment?

Firstly, as a subscriber to NPS investment, you need to treat it like a systematic investment plan. Wondering why? It has a low expense ratio, which will significantly help in increasing long-term performance.

Secondly, you can boost the NPS return rate, as you have the advantage of changing your asset allocation twice a year.

Thirdly, to increase and balance the return rate, you can invest up to 75% in equity.

Major Benefits Associated with NPS Investment

Here is a comprehensive listing of all the significant benefits associated with the NPS:

- Manage your NPS account smoothly with the allotted PRAN

- NPS investment is one of the affordable plans that are available to the masses

- You can get tax benefits while investing in the National Pension System

- You can have the choice to open many NPS accounts

- You’ll have the advantage of changing your fund manager with NPS

Conclusion

People are increasingly leaning towards NPS investment. It is evident that the changing scenarios have led to an increased inclination among millennials towards retirement planning. The fluctuations in the market will keep happening, but you don’t need to bother about that; you just need to remember the benefits of NPS and invest for a worry-free life after retirement. But it is also important to exercise caution when making financial decisions as there are numerous influencers who may not provide comprehensive advice. Consulting a financial advisor can help ensure informed and well-thought-out choices.